The UK's solar landscape to 2030: growth and challenges

The UK's solar landscape to 2030: growth and challenges

Solar power is booming in the UK. In the last 24 months, there has been a massive demand for solar in Europe which is now facing a gas crisis, and the UK is one of countries in a global fight to secure modules (and other solar-related supplies) made in China or by Chinese owned facilities in Southeast Asia.

It should be a nice problem for the industry: huge demand in the absence of government hand-outs. But the UK is subject to the difficulties of being just another country controlled by external forces beyond its control. And over the next few years, many global utilities and corporates will fail to meet their declared goals as part of net zero aspirations or corporate targets, simply by not getting enough stock.

Still, 2022 is a massive year for solar deployment globally. More than 250GW of modules will be produced and shipped, with more than 200GW going to commercial, industrial and utility sites. The goal for end users is to be part of this mix, and not one of many unable to secure supply. This situation is unlikely to change for the next few years.

More than ever, the solar industry in the UK needs to understand that the boom in solar is not localised but happening everywhere globally.

UK’s solar market in 2022

Nowadays, solar panels are mainly of a p-type mono PERC, bifacial in design by default. Module formats are now much larger than a few years ago, consisting of more cells (larger, up to 8 inches) and typically half-cut before module assembly.

The standard offering now for rooftops is close to 400W (mono-facial deployed, even if bifacial capable), with some larger rooftops using 540-550W panels even. For ground-mount, panels are usually 540-550W, with 580-590W versions (or above 600W) also being deployed.

However, many solar farms in the UK will not be constructed for a few years. By this time, it is likely the entire industry will have shifted to even higher performing n-type solar panels, with an extra 30-50W single-side power rating.

There are several drivers in the UK today that will likely push 2022 installations close to the gigawatt-level. The major market sectors of interest within the UK solar sector are commercial rooftops and utility-scale solar farms.

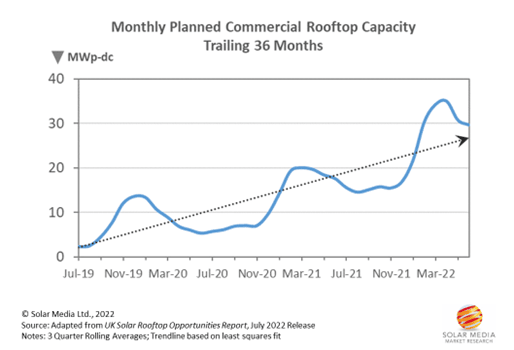

In the past 12 months, there has been a push in planning applications for commercial rooftop space; trending now at about 30MW per month. The graphic below shows this trend clearly; the planned commercial rooftop capacity by month (adding up individual sites above 100kWp-dc), going back to three years to mid-2019, after FiTs had expired.

In relation to ground-mount installations, the sector has been the subject of considerable new site planning. This has seen the pipeline of potential projects grow from just a few gigawatts at the start of 2019 to over 40GW today.

This 40GW figure is comprised of many early-stage applications, both at the local planning authority level (LPA) and, for larger projects, falling under NSIP or Scottish/Welsh government departments.

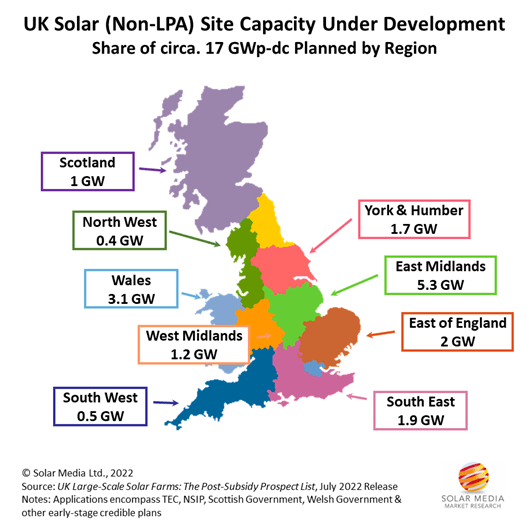

A key part of this 40GW total is coming from mega-scale projects (500MW or above). Currently, there is about 17GW projects spread across the UK under this category as it can be seen below.

Large-scale solar farms under planning are mostly located across the east of England, driven by capacity being freed up by decommissioned coal-fired power stations.

Data from Solar Media shows that in the UK more than 9GW capacity comes from ground-mounted solar panels. But these projects have been met with resistance from public opinion, some land owners and politicians making predictions in this sector difficult.

The good news is that some companies behind the overall 40GW of project pipeline within the UK have gone on record with renewables targets, both globally and within the UK.

For some, having public buy-in for new solar sites in the UK is essential, as it could overlap with a low carbon marketing focus that lumps together nuclear, wind and solar energy supply contributions to the UK market.

For full article: Solar Power Portal, 7 July 2022 by Finlay Colville